Maine sales tax calculator

Lewiston is located within Androscoggin. This includes the sales tax rates on the state county city and special levels.

Sales Tax Calculator Taxjar

Retailers who want to request a payment plan may also contact the MRS Compliance Division at 207 624-9595 or compliancetaxmainegov.

. Maine Income Tax Calculator - SmartAsset Find out how much youll pay in Maine state income taxes given your annual income. Customize using your filing status deductions. In short if the vehicle is.

Fortunately collecting sales tax in Maine is fairly simple. All numbers are rounded in the normal fashion. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Portland Maine.

Most transactions of goods or services between businesses are not subject to sales tax. Youll then get results that can help provide you a better idea of what to expect. So whether you live in Maine or outside Maine but.

Sales and Gross Receipts Taxes in Maine amounts to 24 billion. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Auburn Maine. The average cumulative sales tax rate in Lewiston Maine is 55.

To know what the current sales tax rate applies in your state ie. Maine all you need is the simple calculator given above. Choose the Sales Tax.

Input the amount and the sales tax rate select whether to include or exclude sales tax. Youll then get results that can help provide you a better idea of what to. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55.

Sales Tax and Service Provider Tax Certificate. Exact tax amount may vary for different items. You can always use Sales Tax calculator at the front pagewhere you can modify percentages if you so wish.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 55 in Augusta Maine. This state sales tax also applies if you purchase the vehicle out of state. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

Just enter the five-digit zip code of the. Maine State Sales Tax Formula Sales Tax Rate s c l sr Where. Enter the Amount you want to enquire about.

Long Term Auto Rental. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Brunswick Maine. S Maine State Sales Tax Rate 55 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate The.

Youll then get results that can help provide you a better idea of what to. The car sales tax in Maine is 550 of the purchase price of the vehicle. The state sales tax rate is 55 and Maine doesnt have local sales tax rates.

Maine state sales tax rate 55 Base state sales tax rate 55 Total rate range 55 Due to varying local sales tax rates we strongly recommend using our calculator below for the most. 2022 Maine state sales tax. Just enter the five-digit zip code of the.

Use our simple sales tax calculator to work out how much sales tax you should charge your clients.

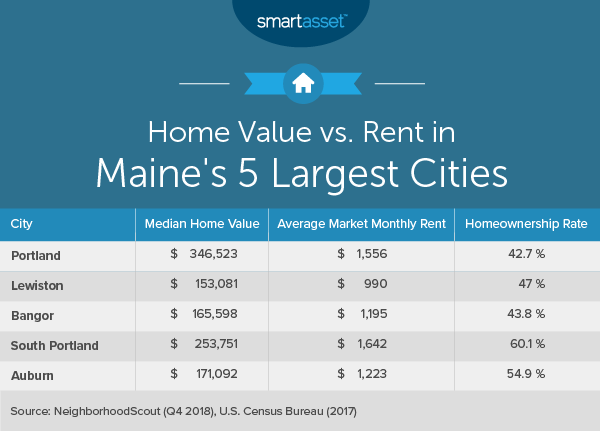

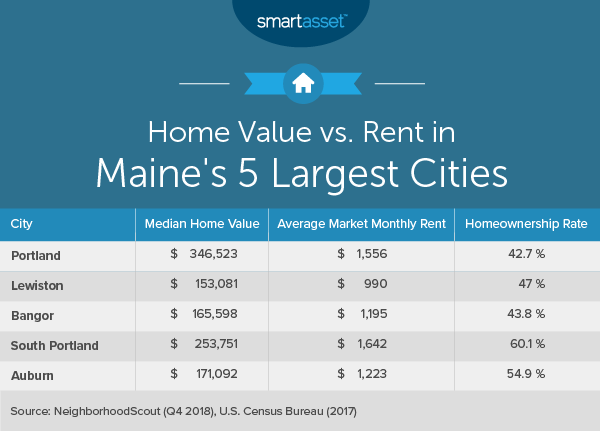

What Is The Cost Of Living In Maine Smartasset

Maine Vehicle Sales Tax Fees Calculator

How To Register For A Sales Tax Permit Taxjar

Maine Sales Tax Small Business Guide Truic

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Maine Vehicle Sales Tax Fees Calculator

Item Price 70 Tax Rate 18 Sales Tax Calculator

Maine Vehicle Sales Tax Fees Calculator

The Most And Least Tax Friendly Us States

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To Calculate Cannabis Taxes At Your Dispensary

Maine Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax By State Is Saas Taxable Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

Maine Reaches Tax Fairness Milestone Itep

Maine Income Tax Calculator Smartasset

Sales Tax Calculator