Estimate the present value of the tax benefits from depreciation

To calculate the depreciation value per year first calculate the sum of the years digits. In this case it is 15 years or 1 2 3 4 5.

Present Value Of Depreciation Allowances Z Download Table

Depreciable basis Ending book value Depreciation Life of asset 912000 142000 10 years 77000 per year.

. Present value 14205905 01 The depreciation per year will be. Tax benefit 30000 034 10200. Estimate present value of tax depreciation claim for two types of equipment We sell a product that potentially offers a tax benefit in the US.

Tax Benefits from Expensing Asset Immediately 25 04 1 million. Depreciation per year Book value Depreciation rate. TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate.

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. Annual depreciation expense 250000 100008 30000. After-Tax Interest Expense Interest Expense x 1 Tc Interest Tax Shield Example Continued.

Estimate the present value of the tax benefits from depreciation. The equipment will have a depreciable life of five years and will be depreciated to a book value of 3000 using straight-line depreciation. APP Operating cycle - Cash cycle 120 - 75 45.

The depreciable amount is 9000. Estimate the present value of the tax benefits from depreciation. The cost of capital is 9 percent and the firms tax rate.

Find Average Payment Period. Round your answer to 2 decimal places With a 30. Additional tax benefit from immediate expensing 1.

Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. The annual depreciation would be computed first and then multiplied by 30 or 030 to find the annual tax savings from depreciation tax shield. Present Value of Tax Benefits from Depreciation 062 c.

The cost of capital is 13 percent and the firms tax. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 150000 using straight-line depreciation. We note that when depreciation expense is considered EBT is.

Or EBT x tax rate. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 150000 using straight-line depreciation. Tax benefit 3000034 10200.

The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 150000 using straight-line depreciation. The cost of capital is 11 percent and the firms tax rate is 30 percent. Estimate the present value of the tax benefits from depreciation.

Estimate the present value of the tax benefits from depreciation. Neither bonus depreciation nor Section 179. Compared to competing products.

Simply subtract the value of the depreciation from your cash flow for each period. Neither bonus depreciation nor Section 179. Annual depreciation expense 250000 - 100008 30000.

For example if you have a cash flow of 15000 for a period and depreciation of 1000 for the. Id like a CPA. Our convertible bond pays out a coupon of 800000 this year.

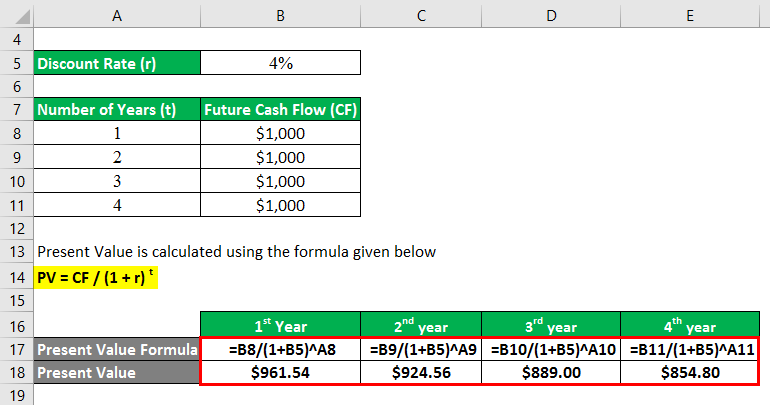

Present Value Formula Calculator Examples With Excel Template

Present Value Formula Calculator Examples With Excel Template

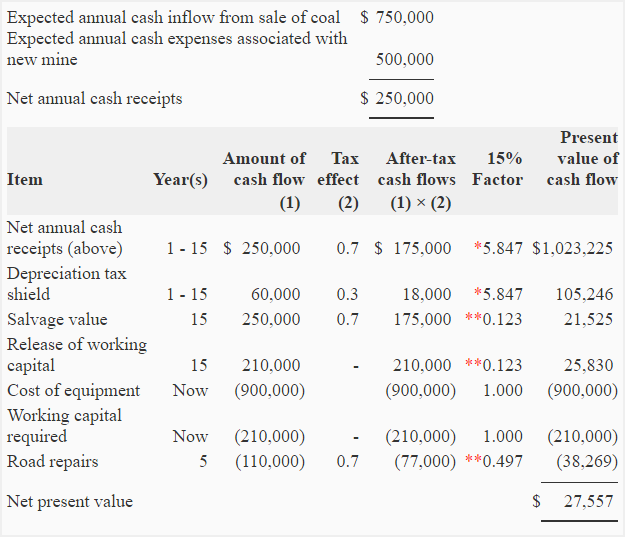

Payback And Present Value Techniques Accountingcoach

How To Calculate Npv With Taxes Youtube

Npv And Taxes Double Entry Bookkeeping

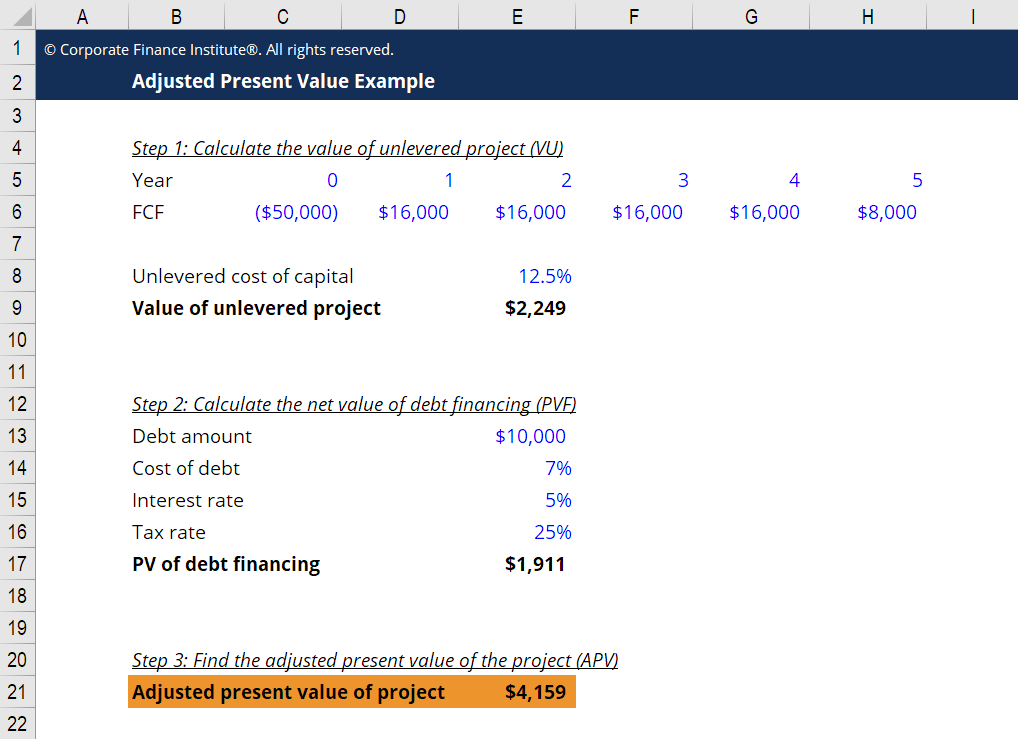

Adjusted Present Value Apv Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Payback And Present Value Techniques Accountingcoach

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Problem 1 Net Present Value Npv Method With Income Tax Accounting For Management

Tax Shield Formula Step By Step Calculation With Examples

Adjusted Present Value Apv Definition Explanation Examples